Irs Schedule 2 2024 – The Internal Revenue Service has announced that income tax brackets and standard deductions will be changing come the 2024-2025 season. The IRS released the information Thursday in its annual . That could provide a break to some taxpayers on their taxes in 2024. The tax agency on Thursday said it’s adjusting the tax brackets upwards by 5.4%, relying on a formula based on the consumer .

Irs Schedule 2 2024

Source : www.irs.gov

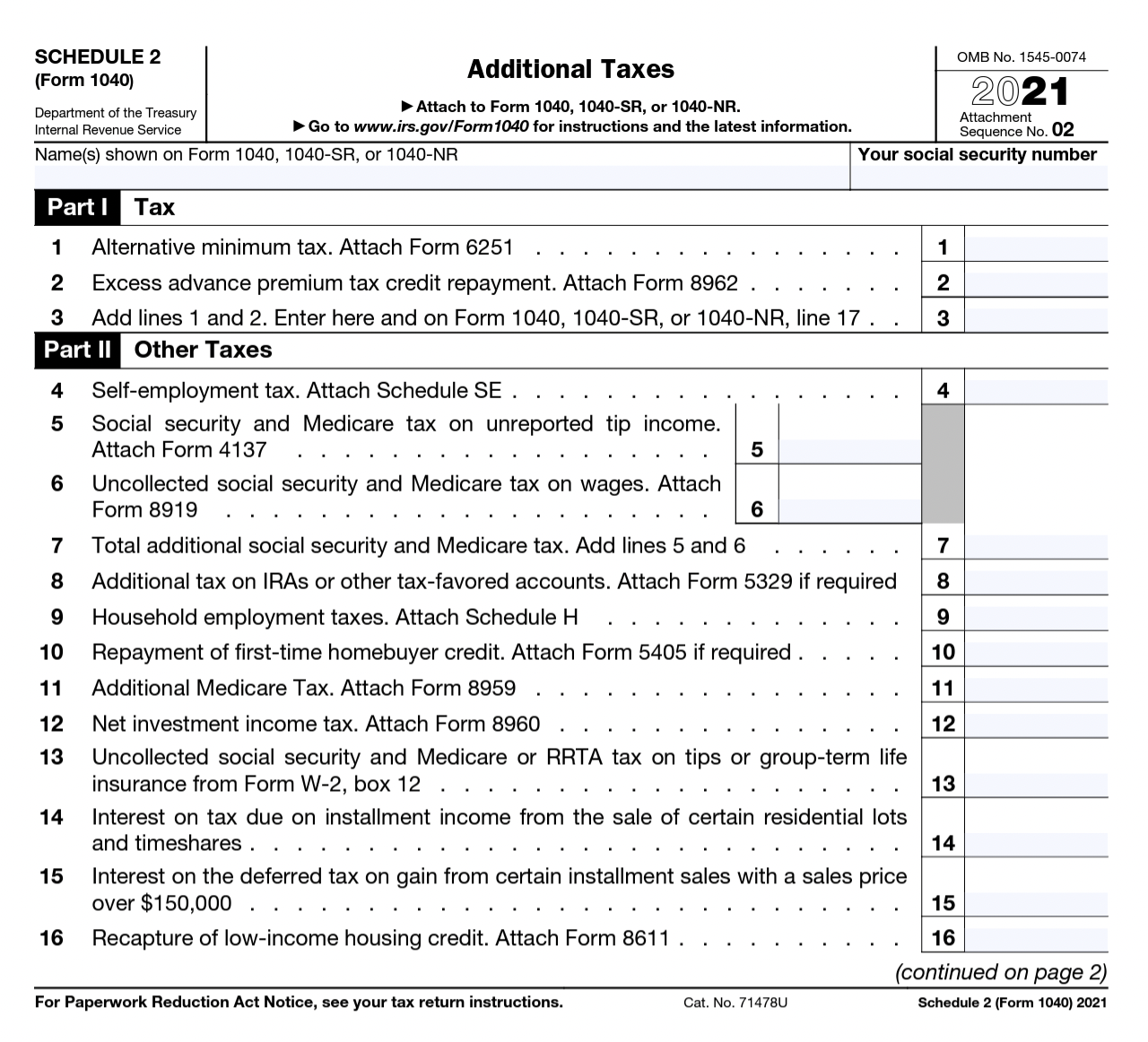

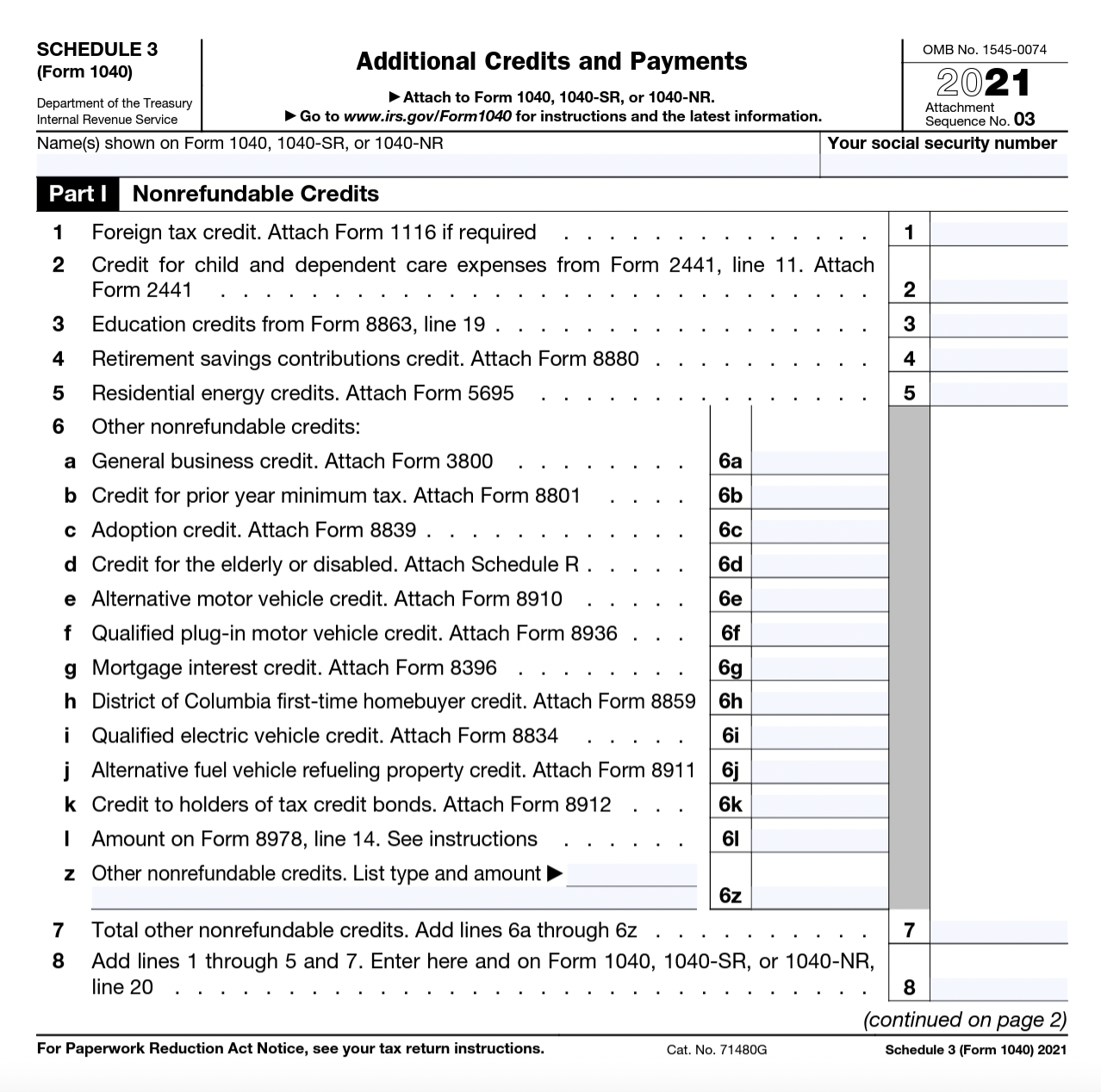

What is IRS Form 1040 Schedule 2? TurboTax Tax Tips & Videos

Source : turbotax.intuit.com

Most commonly requested tax forms | Tuition | ASU

Source : tuition.asu.edu

IRS Holds Off on Major Form W 2 Design Changes Until 2024

Source : www.payroll.org

Most commonly requested tax forms | Tuition | ASU

Source : tuition.asu.edu

Amazon.com: PassKey Learning Systems EA Review Part 2 Workbook

Source : www.amazon.com

Tax Transcript Decoder: Comparison of 2021 Tax Return and Tax

Source : www.nasfaa.org

Budgets 2 Goals | Baton Rouge LA

Source : www.facebook.com

3.11.13 Employment Tax Returns | Internal Revenue Service

Source : www.irs.gov

IRS Form 5498: IRA Contribution Information

Source : www.investopedia.com

Irs Schedule 2 2024 Publication 505 (2023), Tax Withholding and Estimated Tax : In other words, someone with $100,000 in taxable income in 2024 would fall into the 22% bracket, but would owe a tax bill far below $22,000. Get your tax years straight Tax years can get confusing. . The Internal Revenue Service (IRS) on Thursday released updated tax brackets and standard deductions for 2024. While the actual percentages of the tax brackets will remain the same until 2025 .

:max_bytes(150000):strip_icc()/Form5498-135715bd358f41ed99042ea66213b504.png)